Introduction

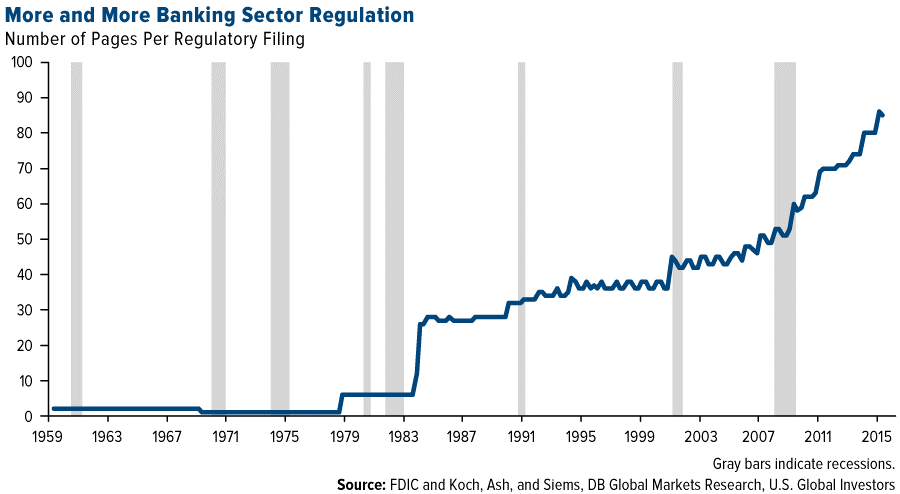

The financial crisis of 2008 – 2009 and the subsequent collapse of Lehman Brothers and AIG in the United States, followed by the bailing out of HBoS and RBS in the UK, created an imperative for changes to the regulation of the financial system to minimize the risk of the same thing happening again. The Financial sector has been, and continues to be, under intense scrutiny and the post-crisis period has witnessed a flurry of regulatory activity, with increasingly stringent and intrusive regulations both at the international and domestic level.

All aspects of Financial Institution’s business—capital, liquidity, systemic risk, supervision, governance, remuneration, —are impacted by one or more of the plethora of evolving regulations. The likelihood is that this regulatory change will continue for the foreseeable future and individuals working in the Financial Sector will almost certainly come across one or more of the regulations either directly or indirectly. The following glossary is aimed at providing brief summaries/descriptions of some of the key regulations and inherent terms, and is aimed at being a starting point for further information if required.

Anti-Financial Crime (AFC): (Previously referred to as Anti Money Laundering AML): A set of procedures, laws or regulations designed to stop the practice of generating income through illegal actions. From a regulatory perspective, the Financial Action Task Force develops and promotes international cooperation to seek to combat money laundering. In the EU, Directive 2005/60/EC introduced measures to seek to prevent the use of the financial system for the purpose of money laundering and terrorist financing. An example of AFC regulations is those that require institutions issuing credit to complete a number of due-diligence procedures to ensure that these institutions are not aiding in money laundering activities. The onus to perform these procedures is on the institutions, not the criminals or the government.

Asia Securities Industry & Financial Markets Association (ASIFMA): ASIFMA is an independent, regional trade association with over 80 member firms comprising a diverse range of leading financial institutions from both the buy and sell side. It seeks to promote the growth and development of Asia’s debt capital markets and their orderly integration into the global financial system. ASIFMA works to develop more open domestic capital markets, more standardised market practices and a more stable and transparent regulatory environment. ASIFMA is the Asia regional member of the Global Financial Markets Association (GFMA).

Association for Financial Markets in Europe (AFME): The Association for Financial Markets in Europe advocates stable, competitive, and sustainable European financial markets that support economic growth and benefit society. It was formed on November 1st 2009 following the merger of LIBA (the London Investment Banking Association) and the European operation of SIFMA (the Securities Industry and Financial Markets Association). AFME represents a broad array of European and global participants in the wholesale financial markets, and its 197 members comprise all pan-EU and global banks as well as key regional banks, brokers, law firms, investors and other financial market participants. AFME provides members with an effective and influential voice through which to communicate the industry standpoint on issues affecting the international, European, and UK capital markets. AFME is the European regional member of the Global Financial Markets Association (GFMA).

Basel Accords: The Basel Accords refer to a set of agreements issued by the Basel Committee on Bank Supervision (BCBS), which provide recommendations on banking regulations. The purpose of the accords is to ensure that financial institutions have enough capital to meet obligations and absorb unexpected losses. Whilst the committee does not have the authority to enforce recommendations, most member countries as well as some other countries tend to implement the Committee’s policies. This means that recommendations are enforced through national (or EU-wide) laws and regulations, rather than as a result of the committee’s recommendations – thus some time may pass between recommendations and implementation as law at the national level.

Basel I – A set of international banking regulations published by the BCBS in 1988 referred to as the “Basel Accord”, which set out the minimum capital requirements of financial institutions with the goal of minimising credit risk. Banks that operate internationally are required to maintain a minimum amount (8%) of capital based on a percentage of risk-weighted assets. Basel I has now been superseded by Basel II and Basel III which provide more sophisticated mechanics for calculating risk- weighted assets.

Basel II – Basel II updates the Basel I Accord published by the BCBS. It was initially published in 2004 and provides a more sophisticated measure of calculating risk-weighted assets. Whereas the Basel I focus was mainly on credit risk, Basel II sets out a comprehensive “three pillars” approach comprising (i) minimum capital requirements, (ii) supervisory review and (iii) market discipline including disclosure.

Basel III – Basel III is a regulatory banking standard agreed to in 2010 by members of the BCBS. It is expected that its implementation will be a lengthy process. Basel III aims to strengthen the regulation, supervision and risk management of the banking sector. Basel III addresses such matters as capital requirements, bank leverage and required liquidity.

Capital Requirements Directives IV (CRD IV): CRD IV introduces significant reforms to the EU’s capital requirements regime for credit institutions and investment firms. CRD IV will replace the existing Capital Requirements Directive (consisting of directive 2006/48/EC and directive 2006/49/

- EC) with a new directive and regulation: the CRD IV Directive (2013/36/EU) and the Capital Requirements Regulation (or the CRR) (Regulation 575/2013). CRD IV aims, in conjunction with the CRR, to implement the key Basel III reforms including amendments to the definition of capital and counterparty credit risk and the introduction of a leverage ratio and liquidity requirements. Member states must transpose the CRD IV Directive and apply its provisions from December 31, 2013.

Central Clearing Counterparty (CCP): A clearing organisation that interposes itself, through Novation, between the two original parties to the transaction, becoming the seller to the buyer and the buyer to the seller. Once interposed, a CCP will use risk management techniques to insulate members from any losses should a default occur. Typical functions of a CCP include calculating margin amounts such as Variation Margin and Initial Margin, paying and receiving coupons and fees on trades, receiving and processing post-trade events such as assignments or terminations and performing netting of portfolios through various methods.

Client Clearing: An indirect member of a CCP that does not meet the eligibility rules to be a direct member is able to clear trades via an intermediary who provides a client clearing service. The intermediary stands between the CCP and the client handling all cash flows including coupons, one-off fees and all margin calls from the CCP to the client. Under Dodd-Frank, clearing members must register as Futures Commission Merchants (FCMs) if they wish to act as intermediary and clear client trades.

Dark Pools: Private or alternative trading venues which operate in parallel to the mainstream exchange-traded market and allow participants to transact without publicly displaying quotes. Orders are anonymously matched and there is no obligation for either party to report executed transactions or the prices at which they are executed to a regulatory body. Price discovery in the mainstream markets can be distorted by such venues, as the transactions processed within them have effectively become Over-The-Counter (OTC) in nature.

Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act): Law drafted in the wake of the 2008 financial crisis and designed primarily to promote the financial stability of the United States via improved regulation of the financial services industry and particularly Over-The-Counter (OTC) derivative products. The key aims of the legislation are to improve accountability and transparency in the financial system, to end the mindset that certain institutions are “too big to fail”, to protect the American taxpayer by ending bailouts and to protect consumers from abusive financial services practices.

European Market Infrastructure Regulation (EMIR): On 15 September 2010, the European Commission published its final proposal for a Regulation of the European Parliament and of the Council (also widely known as European Market Infrastructure Regulation – EMIR), which sets out to increase stability within OTC derivative markets. The Regulation introduces: a reporting obligation for OTC derivatives and a clearing obligation for eligible OTC derivatives; measures to reduce counterparty credit risk and operational risk for bilaterally cleared OTC derivatives; common rules for central counterparties (CCPs) and for trade repositories. It follows, and facilitates the commitment by G-20 leaders, that OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest. OTC derivative contracts should be reported to trade repositories and non-centrally cleared contracts should be subject to higher capital requirements.

European Securities and Markets Authority (ESMA): ESMA is an independent EU Authority that contributes to safeguarding the stability of the European Union’s financial system by ensuring the integrity, transparency, efficiency and orderly functioning of securities markets, as well as enhancing investor protection. In particular, ESMA fosters supervisory convergence both amongst securities regulators, and across financial sectors by working closely with the other European Supervisory Authorities competent in the field of banking (EBA), and insurance and occupational pensions.

Foreign Account Tax Compliance Act (FATCA): A 2010 United States federal law to enforce the requirement for United States persons including those living outside the U.S. to file yearly reports on their non-U.S. financial accounts to the Financial Crimes Enforcement Network (FINCEN). It requires all non-U.S. (foreign) financial institutions (FFIs) to search their records for indicia indicating U.S. person-status and to report the assets and identities of such persons to the U.S.

The Global Financial Markets Association (GFMA) represents the common interests of the world’s leading financial and capital market participants, and speaks for the industry on the most important global market issues. GFMA’s mission is to provide a forum for global systemically important banks to develop policies and strategies on issues of global concern within the regulatory environment. GFMA brings together three of the world’s leading financial trade associations to address the increasingly important global regulatory agenda and to promote coordinated advocacy efforts. The Association for Financial Markets in Europe (AFME) in London and Brussels, the Asia Securities Industry & Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in New York and Washington are, respectively, the European, Asian and North American members of GFMA.

G20 Commitments (OTC derivatives): A group of finance ministers and central bank governors from 20 countries, representing the world’s major advanced and emerging economies. During the Pittsburgh Summit in 2009, the group made the commitment to improve the OTC derivatives markets by implementing compulsory trading on exchange or electronic platforms, clearing, reporting to a trade repository and changes to capital requirements.

International Financial Reporting Standards (IFRS): These are accounting regulations designed to ensure comparable balance sheet preparation and disclosure of financial statements. Publicly listed companies in the European Union are required to use IFRS as adopted by the EU.

International Capital Market Association (ICMA): The International Capital Market Association (ICMA) is a unique organisation and an influential voice for the global capital market. It represents a broad range of capital market interests including global investment banks and smaller regional banks, as well as asset managers, exchanges, central banks, law firms and other professional advisers.

International Securities Market Association (ISMA): A self-regulatory organization and trade association originally located in Zürich, Switzerland, that encourages systematic and compliant trading in the international securities market. ISMA helped to establish standardized trading procedures in the international bond market. It had 430 members in 49 different countries, representing the major securities firms’ entire active in the secondary international debt market.

In July 2005, the ISMA and International Primary Market Association merged to become the International Capital Market Association.

Interest rate swap: This is a financial instrument in which the parties agree to swap different interest rates on an agreed notional amount. The market for standard IRSs is among the largest and most liquid of the swap markets. Many standard IRSs are subject to mandatory clearing.

International Swaps and Derivatives Association, the trade group for the swap industry. ISDA is the most important industry voice in the swaps market.

Know your customer (KYC) is the process of a business verifying the identity of its clients. The term is also used to refer to the bank regulations which governs these activities Know your customer policies are becoming much more important globally to prevent identity theft, financial fraud, money laundering and terrorist financing.

Legal Entity Identification (LEI): Legal Entity Identification (LEI) for Financial Contracts, a Universal Standard for Identifying All Parties to Financial Contracts is a new standard established by U.S. Treasury – Office of Financial Research. It is a key element in the broader effort to understand and monitor systemic risk. Its creation will likely have exceptionally broad impact throughout the financial markets at a very fundamental level. The responsibility to building up the LEI has been given jointly to the Depository Trust & Clearing Corporation (DTCC) and SWIFT.

Market Abuse Directive: The currently applicable Market Abuse Directive (MAD) was adopted in 2003 and established an EU-wide framework for tackling both insider dealing and market manipulation. A review of MAD following the financial crisis led the European Commission to propose that the regime should be updated and strengthened. This resulted in the adoption, in April 2014, of a new Market Abuse Regulation (MAR) and a new Directive on criminal sanctions (MAD 2, also known as the Criminal Sanctions for Market Abuse Directive or CSMAD). MAR and MAD 2 will become applicable for most purposes in July 2016.

MAR will apply to a wider range of securities and derivatives than MAD. MAD currently applies only in relation to financial instruments admitted to trading on the EEA’s main investment exchanges (‘regulated markets’) and to related financial instruments. MAR will also cover financial instruments admitted to trading on other trading platforms (‘multilateral trading facilities’ and ‘organised trading facilities’) and related financial instruments. Commodity derivatives and carbon emission allowances will be covered more comprehensively than at present. The manipulation of benchmarks will be brought within scope

Markets in Financial Instruments Directive (MiFID): is the Markets in Financial Instruments Directive (2004/39/EC). It has been applicable across the European Union since November 2007. It is a cornerstone of the EU’s regulation of financial markets seeking to improve the competitiveness of EU financial markets by creating a single market for investment services and activities and to ensure a high degree of harmonised protection for investors in financial instruments.

MiFID sets out:

- conducts of business and organisational requirements for investment firms

- authorisation requirements for regulated markets

- regulatory reporting to avoid market abuse

- trade transparency obligation for shares and

- rules on the admission of financial instruments to trading

Markets in Financial Instruments Directive II (MiFID ii): Although it brought many benefits, MiFID also had unintended consequences: With trading more divided among venues, it became harder to dispose of big blocks of shares without moving prices. Institutional investors, particularly, migrated to various forms of “dark” trading, which help to conceal the volumes being bought and sold and the prices at which they are willing to deal. Additionally, the impact of technology and the growth of algorithmic and high-frequency trading was not foreseen. Derivatives, contracts that take their value from an underlying asset, were overlooked. In Europe one of the main responses has been to revise MiFID. On 20 October 2011, the European Commission (EC) adopted a legislative proposal for the revision of MiFID. The proposals take the form of a revised Directive and a new Regulation, which together are commonly referred to as ‘MiFID II

The European Parliament voted MiFID II through in April 2014. Implementation of the new measures will take effect from 3 January 2017.

Markets in Financial Instruments Regulation: MiFIR is part of the European Commission’s MiFID II proposals, in conjunction with another directive, to replace MiFID. MiFIR covers the areas where the Commission believes uniform application of the reforms throughout the EU is necessary, such as the exchange trading of derivatives, pre- and post-trade transparency requirements and changes to market infrastructure regulation.

Multilateral trading facility (MTF) is a European regulatory term for a non-exchange financial trading venue. These are alternatives to the traditional stock exchanges where a market is made in securities, typically using electronic systems. The operation of a MTF is considered an investment service. The concept was introduced within the Markets in Financial Instruments Directive (MiFID), Article 4 (15) of MiFID describes MTF as multilateral system, operated by an investment firm or a market operator, which brings together multiple third-party buying and selling interests in financial instruments – in the system and in accordance with non-discretionary rules – in a way that results in a contract. The term ‘non-discretionary rules’ means that the investment firm operating an MTF has no discretion as to how interests may interact. Interests are brought together by forming a contract and the execution takes place under the system’s rules or by means of the system’s protocols or internal operating procedures. The MTF can be operated by a market operator or an investment firm whereas the operation of a regulated market is not considered an investment service and is carried out exclusively by market operators that are authorised to do so. The United States equivalent is an alternative trading system.

The Organisation for Economic Co-operation and Development (OECD) is an international economic organisation of 34 countries founded in 1961 to stimulate economic progress and world trade. It is a forum of countries describing themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seeking answers to common problems, identify good practices and coordinate domestic and international policies of its members.

Organised Trading Facility (OTF): MiFID II introduced a new category of trading venue, the organised trading facility (OTF). Alongside regulated markets (RMs) and multilateral trading facilities (MTFs), this will be a third type of multilateral system in which multiple buying and selling interests can interact in a way that results in contracts. However, unlike RMs and MTFs, an OTF will only relate to bonds, structured finance products, emission allowances or derivatives. Operating an OTF will be an investment service so a person wishing to do so will need to be licensed as an investment firm (IF). The operator of a RM will also be able to operate an OTF.

The main distinguishing factor between RMs and MTFs on the one hand and OTFs on the other is that the execution of orders on an OTF is carried out on a discretionary basis. There are two different levels of discretion for the operator of an OTF: (i) when deciding to place or retract an order on the OTF, and (ii) when deciding not to match a specific client order with other orders available in the system at a given time, provided it is in compliance with specific instructions received from a client and best execution obligations. The operator of an OTF that crosses client’s orders may decide if, when and how much of two or more orders it wants to match within its system. The operator of an OTF that arranges transactions in non-equities may facilitate negotiation between clients so as to bring together two or more potentially compatible trading interests. As a result of this discretion, the operator of an OTF will owe certain conduct of business duties to its clients including acting in accordance with their best interests, appropriateness, best execution and order handling.

The Prudential Regulatory Authority (“PRA”) is one of the two bodies (along with the FCA) which replaced the Financial Services Authority from the 1 April 2013. The PRA is a part of the Bank of England and is responsible for the prudential regulation of deposit taking institutions, insurers and major investment firms. The PRA has two statutory objectives: to promote the safety and soundness of these firms and, specifically for insurers, to contribute to the securing of an appropriate degree of protection for policyholders.

Regulation on Energy Market Integrity and Transparency (REMIT) requires market participants to report wholesale energy market contracts (i.e. contracts relating to both the supply and transportation of electricity and natural gas) within the EU to a new body called Agency for the Cooperation of Energy Regulators (ACER). The intent is to ensure greater transparency in wholesale energy markets reducing the risk that markets are manipulated and the price signals distorted.

Securities Industry and Financial Markets Association (SIFMA): SIFMA was formed through a merger of the Bond Market Association and Securities Industry Association in 2006. It is a leading securities industry trade group representing securities firms, banks, and asset management companies in the U.S. and Hong Kong. It brings together the shared interests of hundreds of securities firms, banks and asset managers. SIFMA’s mission is to develop policies and practices which strengthen financial markets and which encourage capital availability, job creation and economic growth while building trust and confidence in the financial industry.

Solvency II: The Solvency II Directive is an EU Directive that codifies and harmonizes the EU insurance regulation. Primarily this concerns the amount of capital that EU insurance companies must hold to reduce the risk of insolvency. AIM: EU insurance legislation aims to unify a single EU insurance market and enhance consumer protection. The third-generation Insurance Directives established an “EU passport” (single license) for insurers to operate in all member states if they fulfilled EU conditions.

Sukuk Islamic capital markets are made up of two components, stock markets and bond markets. Sukuk are securities structured to comply with Sharia law, which prohibit the charging the interest. . Because the traditional Western interest paying bond structure is not permissible, the issuer of a sukuk sells an investor group the certificate, who then rents it back to the issuer for a predetermined rental fee. Sukuk includes short term and long term papers. These may be issued by the public or private sectors. Sukuk have become the Islamic alternative to conventional bills, bond.

Swap Execution Facility (SEF): A term created by the Dodd Frank Act to designate a facility trading system or platform regulated by the Securities and Exchange Commission and the Commodity Futures Trading Commission, that allows multiple participants to execute OTC derivatives transactions with each other.

Systematic Internaliser (SI) MiFID revised rules in many markets that required trades to be executed through local exchanges. Financial Institutions are allowed to act as “systematic internalisers”, matching customer orders internally rather than showing the to the market. Systematic internalisers (SIs), traditionally called market makers, are investment firms who can match “buy” and “sell” orders from clients in-house, provided that they conform to certain criteria. Instead of sending orders to a central exchange such as the London Stock Exchange, SIs can match them with other orders on its own book. Therefore, SIs are able compete directly with stock exchanges and automated dealing systems, but they have to make such dealings transparent. They have to show a price before a trade is made. After a trade is made, they have to give information about the transaction, just like conventional trading exchanges.

Trade Repository: A Trade Repository or Swap Data Repository is an entity that centrally collects and maintains the records of over-the-counter (OTC) derivatives. These electronic platforms, acting as authoritative registries of key information regarding open OTC derivatives trades, provide an effective tool for mitigating the inherent opacity of OTC derivatives markets.

This market infrastructure is defined and supervised in Europe by the European Securities and Markets Authority (ESMA) under the European Market Infrastructure Regulation (EMIR). Similar regulatory initiatives are conducted in the United States where the Commodity Futures Trading Commission (CFTC) has developed the Dodd-Frank Act regulation, under which Swap Data Repositories are regulated.

Vickers Report: The report by the UK’s Independent Commission on Banking (ICB), dubbed the “Vickers Report” after the last name of the commission’s chair, Sir John Vickers. The report makes several key suggestions. First, banks build up more capital in order to absorb losses. Second, a bank’s investment banking and retail banking operations be kept separate. Third, banks with both retail and investment banking operations put up a “ring fence” around retail operations in order to isolate domestic customers from a potential collapse.

Volcker rule: A proposal by American economist and former Chairman of the Federal reserve, Paul Volcker following the 2008 financial crisis to restrict United States banks from entering into certain kinds of speculative investments. This proposal aims to limit risky behaviour within banks but is narrower than the Glass-Steagall Act. Banks that take retail deposits are not allowed to engage in proprietary trading that is not directly related to the market making and trading they do for customers. There are also significant restrictions/limits on Banks in terms of their owning or sponsoring hedge funds or private equity funds.

Summary

The Financial Sector has seen a significant increase in the volume and complexity of regulatory requirements since the Financial crisis of 2008-2009. Indications are that the focus from Regulators will continue, bringing additional requirements on Banks and other Financial Institutions in order to meet resulting mandatory requirements. Mansion House Consulting (MHC) are well placed to support our Clients in their response to these regulatory changes; As well as providing extensive programme and project governance expertise and associated tools, MHC has strong financial services product and process expertise to work alongside and support our clients’ domain experts.

About the Author

David Mills is a highly experienced Project Manager at Mansion House Consulting, with extensive Change and Process Management experience. He possesses a proven track record in leading major change initiatives across a variety of complex financial products and processes including OTC Derivatives, Syndicated and Traded Loans and KYC processes across a range of high profile financial corporations. David’s key skills include driving change in processes, systems and team structures along with developing and implementing operating and organisational models and location strategies, which involve the optimisation of cost structures through the use of onshore, nearshore and offshore locations.

About Mansion House Consulting

MHC is an international business and technology consultancy, focused exclusively on the financial services sector. We provide high quality, practical and robust solutions for the industry through our team of highly experienced consultants and subject matter experts.

We specialise in change and transformation management, toolkits, regulatory and governance frameworks. We deliver solutions globally to the transaction and investment banking communities, including leading Tier One clients from the financial services industry.

Established in 2009 we have been expanding and evolving ever since, with a team in excess of 300 and listed in the Sunday Times Tech Track 100 on four consecutive years 2013-2016, the London Stock Exchange’s 1000 Companies to Inspire Britain 2015 as well as the Investec Mid-Market 100 list in 2016. Headquartered in London, we have a global presence through offices in Frankfurt, Singapore, New York, Jacksonville (Florida) and Bangalore (India).

To find out more about our services, explore our website www.mansion-house.co.uk or contact:

Mansion House Consulting Limited

Disclaimer

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, the Mansion House Consulting Limited Group, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

© 2016 Mansion House Consulting Limited. All rights reserved.

In this document, “MHC” refers to the UK entity, and may sometimes refer to the MHC group network. Each MHC entity is a separate legal entity. Please see www.mansion-house.co.uk for further information.